Meet Renew. An advanced, strong, healthy, full mouth replacement system.

Get your biggest questions answered and hear from other Renew patients. Get a free consultation or second opinion with Renew.

Watch now

Get your biggest questions answered and hear from other Renew patients. Get a free consultation or second opinion with Renew.

Watch now

The Better Teeth Society

Explore how Renew has changed our member’s mouths (and lives)

Our life good, lifetime guarantee

We guarantee new teeth for as long as you own your smile. Your properly maintained implants are guaranteed for the rest of your life. And, if your dentures need to be replaced, we’ll provide a lifetime of savings and protection.

Why Renew

Advanced Digital Technology

We use cutting edge technology in every part of our process; from scans to milling to surgery, and are backed by over 80 patents making Renew teeth highly advanced and unique.

Exceptional customer experience

From the moment you speak to a Renew Representative, we’re with you every step of the journey. And it doesn’t just end after surgery. With our lifetime guarantee, we’re here to support you for life.

Outstanding value

Renew teeth are a third of the cost of many traditional implant options. With our technologically advanced process, we’re able to give the savings back to you.

How advanced are Renew teeth?

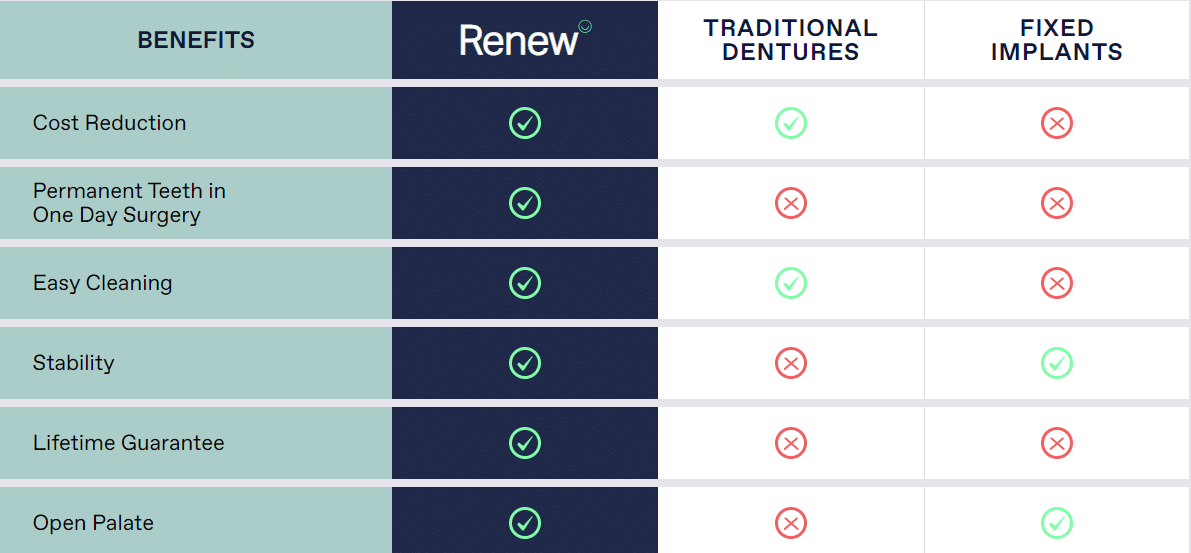

Compare Renew with traditional implants and dentures